O conceito de equilíbrio permeia a história do pensamento econômico desde Adam Smith. Raros são os economistas que se aventuraram em pensar a ciência partindo de outra base, entre eles alguns nomes mais conhecidos são Marx, Schumpeter, Minsky, Veblen, Myrdal, Young e Kaldor. Além desses autores, que recebem pouca atenção da profissão, há outros que recebem ainda menos atenção como Patinkin, Clower e Leijonhufvud que nas décadas de 60 e 70 lançaram uma agenda de pesquisas desequilibrista, virtualmente esquecida pelos economistas contemporâneos.

Esse movimento desequilibrista surgiu como uma resposta à síntese neoclássica de meados do século XX em que o arcabouço Walrasiano foi conciliado com o Keynesiano, inaugurando a era do equilíbrio geral enquanto modus operandi da ciência.

A síntese não se deu sem custos, tanto Walras quanto Keynes foram caricaturizados e não por acaso a agenda de Patinkin, Clower e Leijonhufvud é conhecida como Keynesianismo Desequilibrista. O ceticismo em relação à síntese neoclássica originou um período de intenso debate entre economistas; os desequilibristas ficaram em segundo plano enquanto a atenção da ciência se voltou ao debate entre os Neo-Keynesianos e os teóricos dos Ciclos Reais de Negócios a partir da década de 70.

A ciência econômica tornou-se um campo de guerra até a década de 90, que veria a emergência de um novo paradigma. O consenso entre os Fresh Water e os Salt Water na virada do século, ou a nova síntese neoclássica, lançou a teoria do equilíbrio geral em novas bases: os modelos DSGE.

Assim, nota-se a resiliência do conceito de equilíbrio na ciência econômica.

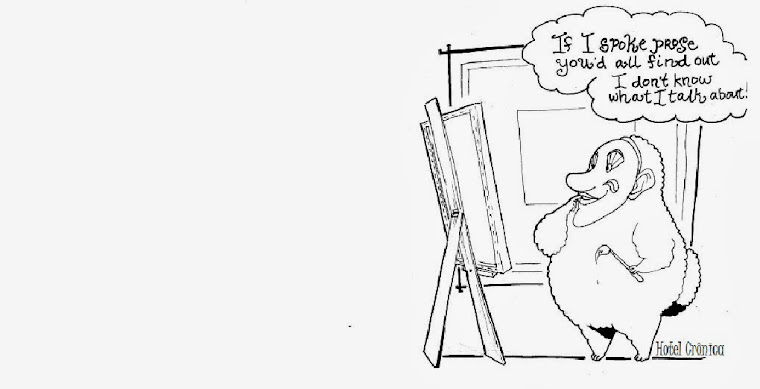

A conclusão elementar dessa estória?

O ponto de equilíbrio da história do pensamento econômico é o conceito de equilíbrio.